Sold on the medical marijuana business, he and Mr. Dobler each invested $3-million in Releaf and raised more cash from family and friends. By 2014, the company – which would later be named Aurora – was starting to build what would become its “Mountain” facility in Cremona. In February, 2015, Aurora was licensed to produce cannabis.

In its early days, Mr. Booth drew on the connections he’d made during his pot pilgrimage to cultivate customers in illegal B.C. dispensaries. The company also courted Alberta customers with a promise of same- or next-day delivery. But in order to really grow in Canada’s medical market, it needed to access a steady flow of patients.

Mr. Booth recognized the inefficiency of going door-to-door to pitch physicians and nurses about a product they weren’t necessarily familiar with, so he set out to acquire clients another way: by buying a pot-counselling service called CanvasRx Inc. Based within a chain of cannabis-focused clinics, the service offered advice to patients about strains of cannabis (individual brands paid to have their pot sold through CanvasRx).

CanvasRx had a patient base of about 10,000, through 17 clinics, most of them in Ontario. Purchasing it would give Aurora access to a sizeable chunk of the market – and an inside look at its competitors’ sales within that chain of clinics. But at the time, money was tight. Aurora was burning through cash as it ramped up production, and by early 2016, he was paying his 40 or so employees out of the bank account of his other business, the inspection company he co-owned with Mr. Dobler.

“I couldn’t raise $50 – except from my friends and family,” Mr. Dobler recalls. Lenders, such as banks, wanted nothing to do with the sector, and retail investors weren’t lining up around the block yet.

But then things started to change. New Prime Minister Justin Trudeau began to outline in 2016 his government’s plans to legalize the recreational use of the drug.

Hedge funds entered the fray and started writing big cheques to cash-starved growers such as Aurora. In exchange, the funds demanded concessions that made these trades a lot less risky than just buying shares in the open market. Much of Aurora’s cash has been raised by selling debt that could eventually turn into stock at a set price. The holder of the debt gets paid interest along the way, and either gets their money back or converts the loan into shares of a rising stock at a lower price.

In 2016, Canaccord Genuity Inc. led a $23-million financing at 40 cents per Aurora share. The deal was pivotal for both companies: It marked the first time a weed offering was brought to market by Canaccord, now a dominant investment bank in the space. And the money helped to finance the purchase of CanvasRx.

That fall, Messrs. Booth and Dobler lent nearly 10 million of their personal shares at no cost to an investor who was buying into two of Aurora’s convertible debt deals, according to regulatory filings. Borrowing stock lowers the risk for these investors because it gives them shares they can sell for cash to hedge against falling prices. Stock loans can be pricey and called back at a moment’s notice. These ones were free and long term. (The loans are still outstanding, almost two years later.)

“Do I like the fact that I had to lend my shares to them? No,” Mr. Booth concedes. “But it was all legal and that’s what they needed. It’s insurance on the price of the stock – in case the market crashed.”

Open this photo in gallery/arc-anglerfish-tgam-prod-tgam.s3.amazonaws.com/public/LI6JQ6MJ3JFOFD7LN3VCLSWLBQ.JPG)

Marijuana plants in the glow of LED lights at the Aurora Sky facility in Edmonton in May. (Jason Franson/The Globe and Mail)

JASON FRANSON/GLOBE AND MAIL

By late 2016, marijuana shares were on a roll. Flush with some cash and fresh off the CanvasRx deal, Aurora’s prospects were brightening. But, behind the scenes, its only production facility was in total disarray. Over the course of six harvests, the firm’s cultivator had watched their yields tank, from 45 grams per plant to 20 grams.

A maintenance worker who’d spotted rusty valves in the growing rooms had ripped them all out and ordered new ones, but replacements couldn’t be delivered for six weeks. In the meantime, Aurora’s pot plants lost a much-needed carbon dioxide supply. Making matters worse, its crops also had thrips, little bugs that can damage plants by blocking light from penetrating during photosynthesis.

It took at least four months to clean up the mess and reach previous production levels. (Since then, it has improved yields at its various facilities further – in some cases, it’s getting 100 grams a plant.)

Many of Aurora’s strains sell quickly, Mr. Booth says. “When we put our Ghost Train Haze, our L.A. Confidential and our Catatonic on our shelves, it’s gone,” he says, naming three of Aurora’s most popular strains of plants. In keeping with his penchant for hyperbole, he added that Aurora’s plants are “healthy, big, thick” and way better than what Ontario-based rivals Canopy and Aphria Inc. offer to patients. “They’re not where we are in the grow.”

This is a small taste of chest-pounding world of Canadian weed, where Mr. Booth – and to be fair, many other cannabis executives – are high on at least one thing at any particular time: hubris.

Open this photo in gallery/arc-anglerfish-tgam-prod-tgam.s3.amazonaws.com/public/GKVGBPMSLBBTBNQSNDH7SWXADM.jpg)

An employee tends to marijuana plants at the Aurora facility in Edmonton in March. (Jason Franson/Bloomberg)

JASON FRANSON/BLOOMBERG

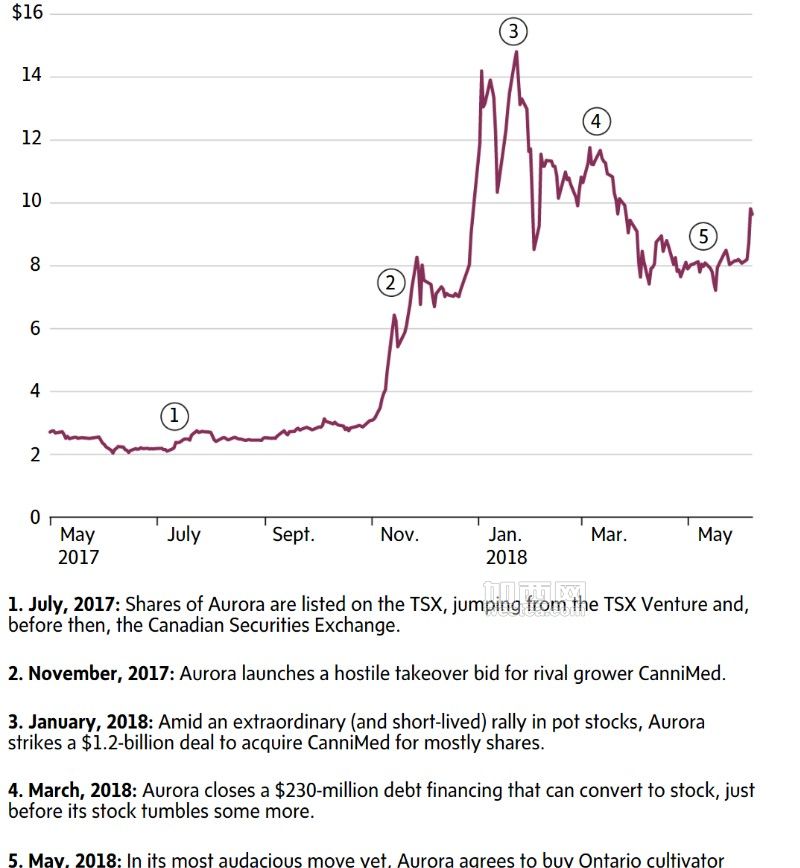

It was an investment in Aurora’s biggest rival in the market, Canopy, that may have helped spark investor interest in Aurora itself – and ultimately, fund Mr. Booth’s future buying spree. Last October, global alcohol giant Constellation Brands Inc. bought a stake in Smiths Falls, Ont.-based Canopy, a signal of confidence in the cannabis sector that spurred a memorable, months-long rally in marijuana stocks.

Aurora’s shares more than doubled in price in a matter of weeks as new investors rushed in. Emboldened by the rise, Aurora made an unsolicited bid for CanniMed that quickly turned hostile, a battle that Aurora would win by January but one that proved costly because the deal was struck at the top of the market. But Mr. Booth didn’t stop there, again using his stock in May to acquire MedReleaf.

The acquisitions fuelled a growing rivalry between Mr. Booth and Canopy CEO Bruce Linton, who made it clear in interviews that he wasn’t pleased to see Aurora benefiting from the Constellation deal. When the MedReleaf acquisition was announced in May, the sector’s biggest deal to date, Mr. Linton said it was like spending “a dollar to buy a dime.”

Mr. Booth counters the snipe with characteristic swagger. “You don’t think the other [licensed producers] were after MedReleaf? Of course they were,” he says, singling out one in particular: Canopy. “C’mon man, you were in the game but you fell short. They didn’t like you as much as they liked us. We were a better fit.”

For his part, Mr. Linton says he’s not looking to buy any more Canadian growers. “I don’t wish to have the distraction of trying to integrate disparate assets when the biggest game’s starting,” he says. “Our big race is to make sure that we ship all the products to all the provinces who said they want it.”

Open this photo in gallery/arc-anglerfish-tgam-prod-tgam.s3.amazonaws.com/public/OJNRMHWLWBHTNIGYRF4A64LDFM.JPG)

A worker pushes a cart of marijuana plants at the Canopy Growth facility in Smiths Falls, Ont., in January. (Chris Wattie/Reuters)

CHRIS WATTIE

Canopy has been busy signing agreements to supply government-run store operators with 25,000 kg of non-medical pot a year, announcing deals with three Maritime provinces, Quebec and the Yukon. It’s also planning to operate its own stores in provinces where it is legal to do so, such as in Manitoba.

In its bid to keep pace, Aurora has also signed a deal with Quebec, which has asked Aurora to earmark a minimum of 5,000 kg a year of cannabis to fill its stores.

So far, Canopy’s leads the industry in terms of production and sales, with 34,569 kg harvested since 2015 and $110 million in recorded sales, compared with 7,000 kg and $62-million for Aurora.

But these growers aren’t stopping at the Canadian border. They have their sights set on conquering the world by making inroads in countries that are now legalizing medical marijuana. It’s how they justify their outsized valuations, and why they say they won’t be dampened by falling prices at home, should legal supply exceed demand in the years to come.

Mr. Booth’s goal, however, isn’t just to be a big cannabis producer; it’s to own a slice of the supply chain. That’s why he’s bought so many pot-industry companies. But that’s where the integration issues could arise.

“It’s a significant amount of cultures and operations to integrate under one umbrella,” warns Mr. Zandberg, the analyst.

To tackle this tall task, Aurora is relying on André Jérôme, who joined the company this February after Aurora bought his company to lead its integration efforts. Mr. Jérôme is a lawyer who spent decades in the telecom industry, helping giants like Vodafone integrate their acquisitions. “I used to worry about it a lot,” Mr. Booth says. “I don’t worry about it as much, now that we have the team.”

Mr. Booth admits the cultures at CanniMed and Aurora have clashed. CanniMed is a “regimented company that did everything by the book and never changed,” he says. He’s assured investors that the MedReleaf transition will be smoother.

Comparing Canada's cannabis giants

AURORACANOPYAPHRIAMEDRELEAFStock Price$8.98$38.54$11.54$26.501-year +/-+341%+422%+126%+202%Enterprise Value$5.0-billion$7.7-billion$2.3-billion$2.5-billionMoney Raised$779-million$1.1-billion$714-million$310-millionTotal Cannabis Grown7 tonnes34 tonnes10 tonnes11 tonnesTotal Cannabis Sold6 tonnes13 tonnes7 tonnes9 tonnesTotal Revenue$62-million$110-million$54-million$94-million

Source: Companies, Bloomberg

Note: Market data as of June 14 close

Canada’s largest marijuana growers are each known for something. Big and first, that’s Canopy. Leamington-Ont.-based Aphria is setting the bar for growing cheaply. Aurora is the acquirer, led by a storyteller. And MedReleaf, known for nurturing a patient base that’s willing to pay more for its bud, is a big opportunity for Aurora. It has registered revenue of $94-million from selling about 9,100 kg of pot, of which every gram was grown by MedReleaf.

Aurora has been rushing to add more growing capacity as part of its international push. A race is under way to establish a global presence before the U.S. moves to ease restrictions that have thus far kept most global behemoths in the world of pharma, alcohol, packaged goods and retail out of the marijuana sector.

But right now, Aurora says it is having trouble keeping up with demand from Canadian patients alone. It’s counting on supply from CanniMed and is expecting its 40,000-square-foot facility in Quebec to be issued a sales licence within weeks.

Next up is Sky, the new Edmonton facility, but there are still doubts about the grow-op. It’s behind schedule – the first harvest will occur this month but it was supposed to take place early this year – and slightly over budget. Then there are worries about quality.

Aurora chief corporate officer Cam Battley admits that three analysts in one week recently told him they heard from speaking with unnamed rival growers that Sky has to be torn down because the cannabis is being polluted by jet fuel and stunted by structural vibrations, caused by being so close to the runway, claims that Mr. Battley says are “demonstrably not true,” adding that, “These are active attacks on us and I think I know why: We’re shaking things up and making people nervous.”

Sky’s next test will come in mid-July, when Aurora is scheduled to host analysts and investors for tours. Then, the market will be waiting to see how long it takes Health Canada to issue a sales licence. Proving that Sky actually works should quell fears about two ongoing and even bigger construction projects by Aurora, one in Medicine Hat, Alta., and another in Denmark.

“The best answer to the rumours is just opening up Sky,” Mr. Battley says. “Nobody’s going to be able to throw any criticisms at us once we show them the product we are producing.”

For Mr. Booth, questions, doubts and criticisms come with the territory. After all, settling for second best isn’t his style.

“We’re all these trailblazers, knocking down these doors,” he says. “When you’re the one knocking down the doors, you know why they were knocked down. It’s different than just coming through it afterwards; you didn’t even know there was a door there.”

论坛通告:

论坛通告:

个人空间:

个人空间:

论坛转跳:

论坛转跳:

/arc-anglerfish-tgam-prod-tgam.s3.amazonaws.com/public/LSRVEGKN35F4RFOE7OEFKTVHAI.JPG)

赞

赞  花篮

花篮  投诉

投诉 踩

踩  分享

分享

/arc-anglerfish-tgam-prod-tgam.s3.amazonaws.com/public/LI6JQ6MJ3JFOFD7LN3VCLSWLBQ.JPG)

/arc-anglerfish-tgam-prod-tgam.s3.amazonaws.com/public/GKVGBPMSLBBTBNQSNDH7SWXADM.jpg)

/arc-anglerfish-tgam-prod-tgam.s3.amazonaws.com/public/OJNRMHWLWBHTNIGYRF4A64LDFM.JPG)